Grand jury indictment for Canadian director

Steven Nerayoff, a US lawyer who advised a number of digital currency companies and initial coin offerings (“ICOs“) was indicted by a Grand Jury on January 10, 2020, in New York.

Nerayoff is, or was, the Chairman of a British Columbia public company called Global Blockchain Technologies Corp. According to SEDI, he remains a director of it and an insider as that term is defined under the Securities Act of British Columbia. It is possible that he ceased to be a director but failed to complete his SEDI filings.

Arrested in 2019

Nerayoff was the subject of a criminal complaint unsealed in New York in September 2019, and was arrested. According to that criminal complaint, he allegedly threatened to destroy a Seattle company if it did not pay him over US$8 million.

On January 10, 2020, Nerayoff was then indicted by a Grand Jury with conspiring to obtain digital currencies and money by extortion and threats of violence, force and fear and with extortion over threatening to injure the reputation of executives of the company.

Since then, Nerayoff has changed lawyers a number of times and may be in plea negotiations.

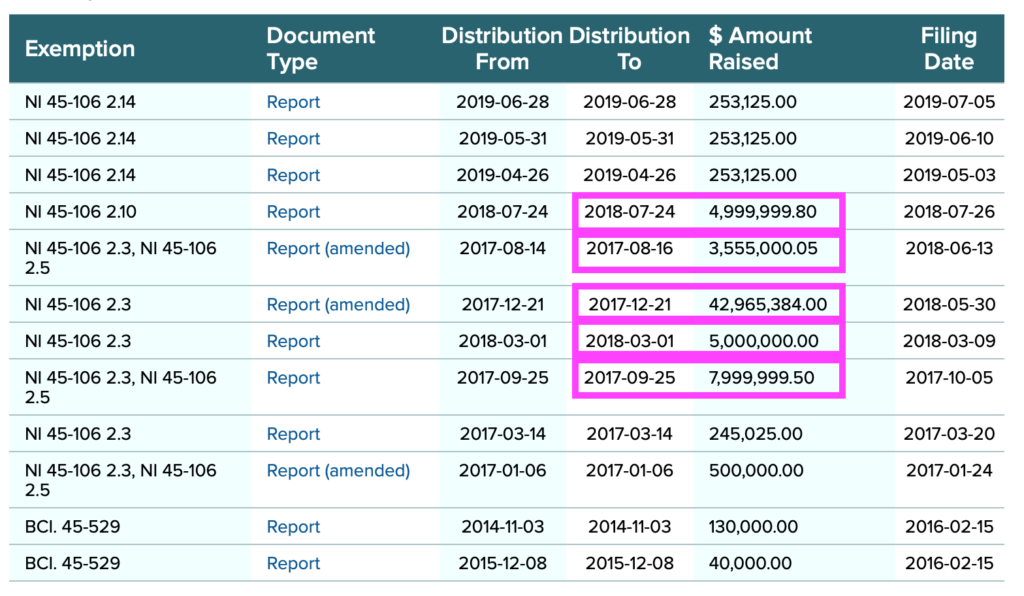

Adding Blockchain to the company name allowed it to raise $64 million

According to its public securities law filings, Global Blockchain Technologies Corp. changed its name to Global Gaming Technologies Corp. and seems to have disposed of substantially all of its Blockchain undertakings in the corporate law sense.

But before then, it had changed its name to be a “Blockchain” company just at the height of the Blockchain and ICO craze, which changed its investment fortunes. It raised $64 million in 12 months as a Blockchain company in Vancouver, when as a non-Blockchain named company, it had raised $245,000 during its last fund raising event. Previously, it was a mining company in British Columbia.

The details of how it spent $64 million from shareholders raised in one year is not entirely evident from its SEDAR filings, partly because the material contracts evidencing contractual obligations to make material payments are elusive on its SEDAR page. It did file its financials and did disclose, however, that it accepted investment funds from shareholders in the US, Barbados, Bahamas, Cayman Islands, the Marshall Islands, Thailand and Hong Kong, as well as Canada. Pubcos are required to file all material contracts on SEDAR for the investing public. What is material is in reference to the public, not the pubco and generally means any information that is relevant to the investing public that could affect the price of shares in a pubco. Without question, a mining shell that morphed instantaneously into a Blockchain shell spending more than $250,000 is a material event for that pubco and all of the material contracts in respect thereof ought to have been filed as a continuous disclosure matter.

A series of unusual announcements

Global Blockchain Technologies Corp. had some unusual arrangements announced in its public disclosure documentation, and if the arrangements were not unusual, the details announced were peculiar.

For example, on December 12, 2017, Global Blockchain Technologies Corp. announced an agreement with a company called Coinstream Mining Corp. whereby it would give US$10 million cash to Coinstream Mining. Coinstream Mining would then give US$10 million to a company called Cryptoba Corp. Cryptoba would then build a mining farm. Cryptoba would then give 12,500 Bitcoin to Coinsteam Mining over five years equal to 2,500 Bitcoin per year for a negligible price. The experience of Coinstream was that, at the date of the news release, it had mined a total of two Bitcoin. The consideration back to Global Blockchain Technologies for writing a cheque for US$10 million was not clear except that it would potentially acquire shares of Coinstream Mining Corp. but would not get back any of the Bitcoin being mined with the US$10 million from its shareholders.

On December 12, 2017, the price of Bitcoin was US$17,415.40. The delivery of 2,500 Bitcoin per year on that date was a deal worth US$43 million per year so why a 75% discount and how did that comport with a FMV analysis? Moreover, the whole of the five year deal was worth US$217,692,500 at that date using the then price of Bitcoin, so why was it priced at just US$10 million and why would shareholders agree to walk away from US$207 million?

On December 21, 2017, it announced that a subsidiary it owned, called Global Blockchain Mining Corp., received regulatory approval (it didn’t say which regulator) to spend US$20 million of investor funds in China buying Bitcoin mining equipment but that it was not going to mine Bitcoin with the mining equipment – rather it was spending US$20 million to buy Bitcoin mining equipment for investment purposes. The company also said that US$10 million of that Bitcoin mining equipment would be given to Coinstream Mining instead of the US$10 million cash pursuant to the verbal deal described above. What would happen to the other US$10 million in Bitcoin mining equipment that it said the regulator signed off on, was not clarified in its news release. What consideration would flow back to the investors of Global Blockchain Technologies Corp. from the giving of US$10 million in equipment to Coinstream Mining was not addressed in the news release. How the subsidiary would pay back the parent company for the advance of US$20 million for the subsidiary to buy equipment in China was not disclosed in the news release.

Later, Global Blockchain Technologies Corp. disclosed that some of its mining equipment ended up in New York State, where Nerayoff lives. Three months later, after raising $42 million, it appears to have been out of money and raised another $5 million and announced that it had bought Coinstream Mining Corp. and that the Bitcoin mining equipment was in Mozambique and Manitoba. There appears to be not much in the way of subsequent disclosure in respect of the 12,500 Bitcoin that was to flow back to someone somewhere sometime worth US$217,692,500.

A month later, it announced it had transferred all of its assets related to its US$20 million in mining equipment and presumably the $217 million in Bitcoin under the Coinstream-Cryptoba deal that remained deliverable until 2022, to a company called Metaverse, which was the new name for its subsidiary. Here, it is described as its own listed entity that is non-arms length – it shared the same directors.

Nerayoff was quoted as saying, in his capacity as chairman of the Vancouver-based entity, that several digital currency exchanges were basement operations handling millions and millions of dollars in transactions and that Global Blockchain Technologies Corp., together with Coinstream Mining, would change that and deliver professional exchange services. So what happened there? Global Blockchain Technologies Corp. never operated a digital currency exchange, according to its disclosure documentation.

Shares halted and cease traded

Subsequent to the unsealing of the complaint against Nerayoff in September 2019, the shares of Global Blockchain Technologies Corp. were halt traded by IIROC. And then they were cease traded by the British Columbia Securities Commission. It seems like it is out of money again.

$6 million to consultants

It August 2019, it filed audited financial statements disclosing that it had only $8,052 in its bank account, having paid consulting fees of $4,324,673 in 2018, and $2,253,608 in 2019, for a total of $6,578,281 in fees paid to consultants alone in 24 months. That’s over 10% of funds raised in that one year from investors on consulting fees, paid over two years. For perspective, WHO, the UN agency, also paid $4 million in 2018 for consultants but that was for a team of highly educated world leading experts.

Nerayoff has said that he worked, possibly still works, with a number of Toronto digital currency ICO issuers, not only Ethereum but Polymath and AION. A digital currency exchange in Toronto called Hyperion Crypto Exchange Inc. is partly owned by Global Blockchain Technologies Corp., and it alleges that it is a listed ATS by the SEC and works with the Ontario Securities Commission. All of that, and more, is described in an earlier post here.

Nerayoff has apparently alleged that he invented the Ethereum ICO and Polymath has backed up that allegation, with a representation to the public that Nerayoff is the co-founder of Ethereum.

Global Blockchain Technologies Corp., aka Global Gaming Technologies Corp., has not filed its latest material information on SEDAR, including news of its halt trade or cease trade. It may be cease-traded but it has not ceased to be a reporting issuer that must report on SEDAR.