Indictment for mixing service

On February 13, 2020, the US government unsealed an indictment against Larry Dean Harmon, the alleged founder of a Bitcoin mixing Bitcoin service, and of a darknet search engine that hooked up with the now-defunct illegal Canadian darknet site called AlphaBay, operated by Alexandre Cazes.

The mixing service was called Helix and the darknet search engine was called Grams. The US government alleges that Harmon operated a Bitcoin money laundering service and promoted and obfuscated the proceeds of crime derived from drug trafficking and other darknet illegal activities.

With respect to AlphaBay, it was shut down by US law enforcement. AlphaBay operated the world’s largest darknet illegal site accessible on TOR that resulted in the death of several teenagers from fentanyl overdoses. Its Canadian owner was arrested by US law enforcement and committed suicide in custody before being extradited.

Illegal drugs cited as a “victimless crime”

On this website, the unidentified founder of Grams and Helix, described Helix as the definitive Bitcoin cleaner, which, for a 3% fee, will “clean your Bitcoin” and went on to make this statement “victimless crimes such as using drugs is everyone’s right and is the purpose of the darknet” and that he “likes being on the frontier of the Internet’s dark side.”

Over US$311 million in Bitcoin washed

Harmon’s mixing service is alleged to have washed over US$311 million in Bitcoin and to have partnered with AlphaBay to launder money.

Mixers and tumblers are a form of Blockchain smurfing

The way mixing and tumbling services work is that they accept Bitcoin from a wallet address, let’s say of a hypothetical drug dealer, and split and run it through up to 20 different wallet addresses, or more, several times, to generate 20 – 100 different addresses with different amounts, and then send the Bitcoin back to the drug dealer minus service fees.

In the banking world, a parallel is if a bank took $1 million from a drug dealer into one bank account and then opened up between 20 to 100 new bank accounts for the drug dealer and split the $1 million into random non-logical amounts and credited the 20 to 100 bank accounts with each portion of the $1 million, and did that again, and perhaps again, before returning the $1 million minus 3% in fees to the drug dealer. The services that are rendered by tumbling and mixing are smurfing services. Such a bank, engaging in deliberate smurfing, as that term is known in anti-money laundering law, would be shut down yet banks continue to provide banking services to companies that operate tumblers and mixers and to their founders, and to digital currency exchanges that support them.

Bitcoin tumbling and mixing makes tracing the flow of funds next to impossible and that’s the reason they exist.

(Source: Instagram)

Some people who use mixers and tumblers that anonymize Bitcoin transactions and anonymize the transactors involved in those transactions, believe that financial privacy in connection with digital currencies is a human right.

Mixers and tumblers purposely defeat the rule of law

In law, the opposite is true – separate and apart from the issue of the legality of smurfing activity, it is not lawful to operate an enterprise that purposely or indirectly defeats the rule of law, and denies certain constitutional rights, including the right to seek redress through the judicial process. Mixing and anonymizing services expressly promise consumers that their financial transactions will be impenetrable, meaning that no court of law or law enforcement agency will be capable of uncloaking transactions to reveal the identity of transactors. Such obfuscating technology is created to ensure that the right to recover for criminal, fraudulent or civil purposes is purposely defeated.

Canada has a disproportionate number of Bitcoin tumblers and anonymizing services that have found safe harbor.

Not registered as MSB

The Helix tumbling and mixing service is alleged to have operated from Belize and the US, and to have conducted financial transactions of Bitcoin all over the world and remitted those transactions without being registered with FinCEN or registered as an MSB in any state in the US. Harmon was also charged, as a result, with operating an unlicensed money transmission business and with transmitting funds known to have been derived from criminal activities.

Harmon has property in Belize, Ohio and Colorado. The administrator of AlphaBay, Bryan Connor Herrell, lives in Colorado too. He pled guilty in January 2020, for his role in AlphaBay and is expected to be sentenced in May 2020, for up to 20 years in jail. In 2014, Herrell was arrested for allegedly operating a mobile forgery business. He is not in custody.

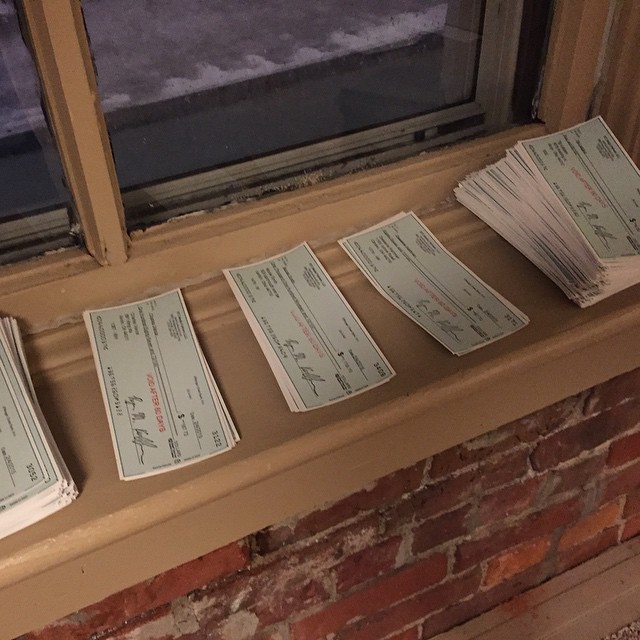

Harmon is also known as “coin ninja” and also operated a company that created a Bitcoin wallet service called DropBit. Harmon put his Insta on lockdown but the company’s Insta is still live. His brother who is part of DropBit it appears, has an open Insta here with videos of being in Belize and of sending out massive amounts of cheques for something that allows you to “rent out your account” for $100 a month.