SEC complaint

The US Securities and Exchange Commission (the “SEC“) filed charges against three Canadians, four Americans and nine private companies in the US District Court for the Southern District of California, for numerous violations of the Securities Act of 1933 and the Securities Exchange Act of 1934, for alleged manipulative market behaviour, including pump and dump schemes involving at least 20 microcap issuers.

One of the issuers, Abby, Inc., lists its principal securities regulator as Alberta and another, VMS Rehab Systems, is based in Ottawa. A third, Argus Worldwide Inc., had an office in Ottawa and its contact telephone number is in Ottawa: (613) 731-5935, a number shared with VMS Rehab Systems and several past issuers such as NPS International Corporation, AuraGenix and Seakinetics Corp.

The SEC alleges that the defendants made over US$6.6 million from illegal trades.

The nine companies named as defendants are Adtron Inc., dba Stockpalooza.com, ATG Inc., DOIT, Ltd., DOJI Capital, Inc., King Mutual Solutions Inc., Optimus Prime Financial Inc., Orca Bridge, Redline International and UAIM Corporation.

Canadians allegedly participated in scheme

The three Canadians are Andrew McAlpine, who resides in the Cayman Islands and operated a brokerage firm in Belize; Ontario-based Ashmit Patel, a securities lawyer who practices in Illinois; and Ottawa-based Michael S. Wexler, the CEO of two of the microcap issuers.

The four Americans are Ongkaruck Sripetch, who goes by other aliases; Amanda Flores; Brehen Knight; and Dominic Williams. Williams allegedly controls Optimus Prime. (Optimus Prime is also the name of the leader of the autobots from the film Transformers).

Entities associated with McAlpine have been charged by the SEC in the past.

Activities undertaken in concert

The SEC complaint alleges that all of the defendants worked in concert to: acquire shares of various microcap issuers; pay for the promotion of those issuers using third parties, such as Stockpalooza.com, in order to cause the price of the shares to increase; and sell those shares when the market prices had been artificially increased from paid promotional activities.

One of the microcap issuers that the network allegedly paid for the pumping of, using Stockpalooza.com, was Argus Worldwide Inc.

The SEC also alleges that some of the defendants engaged in scalping and wash trading to cause share prices and trade volumes to increase artificially. Some defendants are also accused of selling restricted shares before the expiry of the hold periods. The alleged pumping and dumping of the shares of two Canadian entities – Abby Inc. and VMS Rehab Systems, are described in the SEC complaint in detail here.

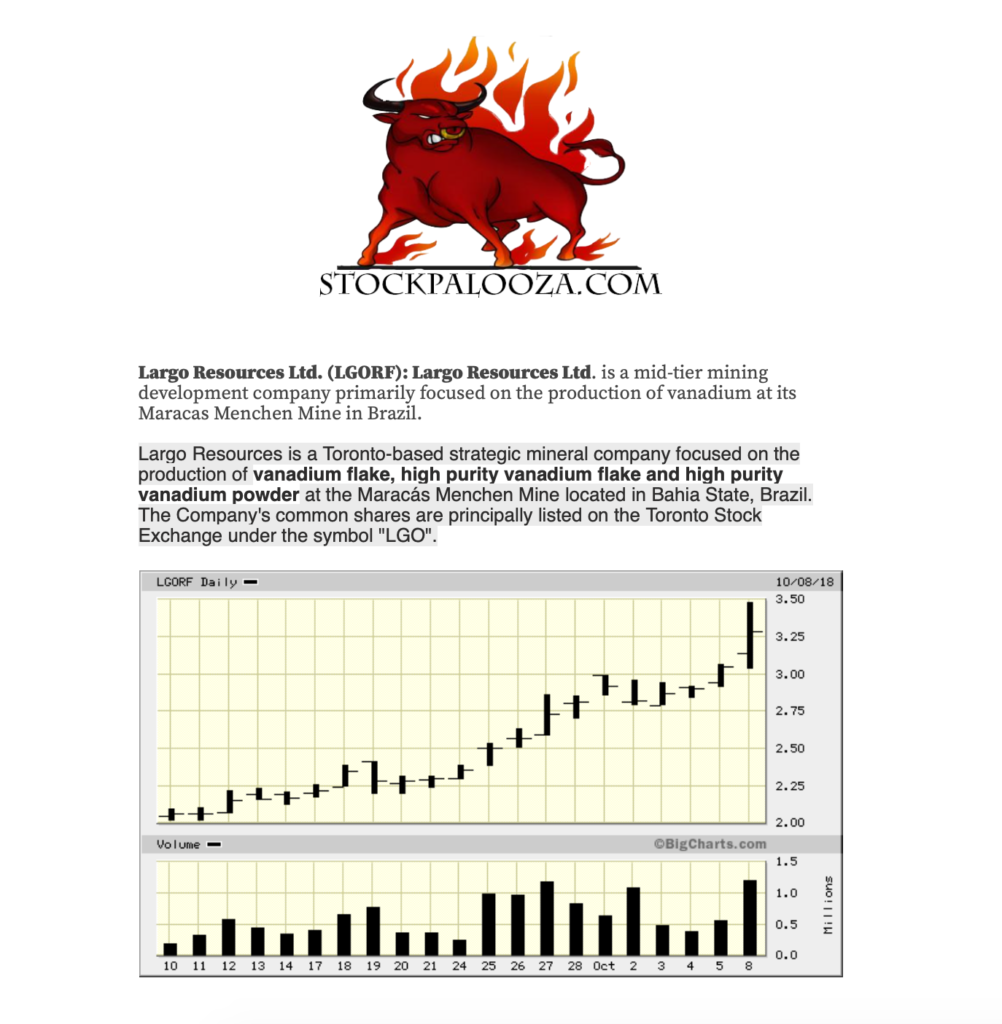

Stockpalooza.com issued a promotion campaign of other issuers not named in the SEC complaint, including for an issuer named Largo Resources Ltd.

Securities lawyer alleged participation

Based on the allegations in respect of Patel, he appears to have acted somewhat like a broker and a banker for some of the defendant entity clients, selling their shares, receiving proceeds from the sales and disbursing the proceeds back to the clients, minus commission.

Patel was accused in the past by the Alberta Securities Commission of participating in a pump and dump fraud scheme with another lawyer in Calgary, Canada. The two lawyers allegedly made false claims in respect of mining interests in Africa and Alberta to boost the share price of an Alberta-based mining microcap issuer, and then allegedly sold shares of that mining issuer when the prices were artificially high and subsequently, violated the terms of a regulator’s order by trading during a cease trade order.

Parellel criminal indictment unsealed

A parallel criminal case was filed by the US Attorney’s Office for the Southern District of California following an indictment obtained in January, 2020, against Sripetch, Wexler, Patel and McAlpine for alleged pump and dump activities associated with the same scheme.

Sripetch was arrested in the US. He was transferred to California from Washington State.

McAlpine arrested en route to Toronto

McAlpine was arrested by the FBI when a private jet he appears to have arranged from the Cayman Islands to Toronto, made a stop in Florida.

Chances are that Sripetch and McAlpine were arrested on the same date because it was the first date following the filing of the indictment in January 2020, that McAlpine booked a flight out of the Cayman Islands and traveled over US air space. Indictments are often sealed until arrests can be coordinated, especially if it involves foreign nationals.

The Canadians, Wexler and Patel, are in Canada. An arrest warrant was issued for each of them in the US. Wexler is a long time member of the Rideau Club in Ottawa.

List of microcap issuers

The microcap issuers whose shares were manipulated by one or more of the defendants, according to the SEC complaint, are:

- Abby Inc.,(ABBY) (it shares a CEO telephone number with Smart Ventures Inc.);

- Acadia Diversified Holdings Inc., (ACCA);

- American Transportation Holdings Inc., (ATHI);

- Andiamo Corporation;

- Angus Worldwide Inc., (ARGW);

- Capital Ventures Europe PLC, (CPVNF);

- Freedom Energy Holdings Inc., (FDMF);

- Formosa Liberty Corporation, (FLIB);

- Global Green Inc., (GOGC);

- Glow Holdings Inc., (GLOH);

- Kabe Exploration Inc., (KABX);

- Mirge Energy Corp., (MRGE);

- NI Technologies Inc., (NTCHF);

- One Step Vending Corporation, (KOSK);

- REAC Group Inc., (REAC);

- Smart Ventures Inc., (SMVR);

- Super Directories Inc., (SDIR);

- Textmunication Holdings Inc., (TXHD);

- Transnational Group Inc., (TAMG);

- Van Gold Resources Inc., (VGRI); and

- VMS Rehab Systems, Inc., (VRSYF).