Once upon a time there was an issuer in British Columbia that went through so many pivots, one’s head spins reading their Sedar filings. Its name is StillCanna. We went through its Sedar filings for the sole purpose of documenting how some issuers pivot.

The issuer started out as Symbio Capital Corp., as a CPC hunting for a QT, founded, inter alia, by a self-described promoter named Richard Haslinger, and Ron Miles and David Franklin, a lawyer in Ontario.

In 2012, Symbio announced its IPO, selling securities offshore and raising $600,000.

All was quiet until 2014, when it announced it had entered into an option agreement in respect of mineral claims. An option agreement in the British Columbia mining ecosystem is an option to exercise an option for a right to acquire a mineral right.

Back in the day, issuers paid certain parties, often the same set of parties across Vancouver, exorbitant amounts of consideration for options to exercise an option to acquire a mineral right. For example, Symbio was on the hook to pay consideration of $100,000 plus 1 million shares for its option to acquire an option. The fact that its 43-101 said there were no mineral reserves or mineral resources on the mining property, and that no testing for one mineral was done on the site, appears to have been immaterial.

In 1998, Vancouver Sun reporter David Bains, wrote about a Vancouver issuer named Auromar Development Corp., that he said pumped out “steroid-enhanced news releases” in which the issuer alleged to investors that it would produce $10 million in diamonds per year. The stock flew up to $7. Not one diamond ever emerged from the site.

According to a Forbes Magazine article, Auromar’s lawyer in Vancouver recommended that Auromar merge with a company called Casmyn Corp. to remove it from Canadian jurisdiction to avoid a potential criminal investigation. Basically, the legal advice was what to do to defeat the rule of law. Casmyn faced similar allegations of having promoted a stock based on misrepresentations. In the end, it was the professional insurers of the gatekeepers – the lawyers and the auditors – who paid out shareholders who sued for losses from securities fraud – but not in Canada – in the US. Deloitte, in its capacity as auditor of the issuer, paid US$2.3 million and the insurer for the lawyer of the issuer paid US$900,000.

Back to the issuer; new natural persons entered into the picture with the acquisition of the option to exercise an option, including Jason Leikam, Nick Ayling, Faisal Manji, George Nicholson and a Richard Simpson. Ayling was, perhaps still is, a securities lawyer, according to the issuer’s disclosure.

In 2014, the issuer changed its name to Blackeagle Development Corp. And in 2016, it announced plans to get into the silica sand business and to change its name to EVI Global Developments Corp. with a view to expanding into China.

We don’t know if it ever extracted silica or expanded into China.

In 2016, it later announced it was getting into gold.

By mid-2017, the issuer announced it was onto new things and it was now entering the money services business by acquiring an online MSB, in essence a foreign exchange and payment processor.

Days later, it announced it was back in the silica business too.

The summer announcements weren’t over. Two months later, it announced a third line of business into cannabis, acquiring shares from Matthew Kyska. A Chris Yu-Kai Hung then joined the board.

Material contracts were not filed on Sedar in respect of many of these deals.

A mere six months later, the issuer was back into mining – in Peru this time.

A month later, it was back into FinTech, specifically back into payment processing and announced it was acquiring a global payments processing processor called CashTeleport Inc. that operated as an online money transmitter (an MSB) for consideration of $5 million. The issuer said it hoped to be able to cash teleport. We can find no trace of an MSB or payment processor that operated globally, even locally, called CashTeleport Inc.

A week later, Brendan Purdy, from the Vancouver issuer Global Blockchain Technologies Corp., another securities lawyer in the microcap space, joined the issuer.

The issuer then completed a plan of arrangement and Jason Dussault joined the issuer, followed by an executive from a home gutter cleaning service named Denis Semenov.

By September 2018, it was back into cannabis, acquiring a company in the EU.

In 2019, the issuer announced a name change to StillCanna Inc. and a series of cannabis deals in Eastern Europe and the listing of its shares in the US and Germany.

A few weeks later, it announced another microcap securities lawyer by the name of William Macdonald was joining the issuer to replace the executive from the home gutter cleaner, as a director.

But not just that, the issuer announced that the lawyer was going to be acting as both a director of the issuer and legal counsel, providing advice in respect of the issuer’s legal obligations.

Since the days of lawyer Michael Seifert (coincidentally who was a finder, twice collecting a finder’s fee in convertible units with the same now-cease-traded issuer Global Blockchain Technologies Corp. as Brendan Purdy, mentioned above), it used to be that it was not permitted for a lawyer to act qua director of an issuer, and as legal counsel with a financial interest in the issuer but that rule has not been enforced, ever, in 20 years and a review of many British Columbia issuers shows that lawyers are acting as both at the same time, being remunerated in both capacities, and having a direct additional financial interest by holding shares, and voting on consent resolutions they drafted to give themselves RSUs and PSUs.

A filing was recently made to an enforcement agency of a lawyer who is wearing 6 hats at a Vancouver issuer – as lawyer, as director, as shareholder, as advisor, as stock promoter and as a finder, being remunerated in all six capacities. That lawyer is now being sued in another jurisdiction. Seifert was a law partner with Jeffrey Lightfoot, who is the partner of the lawyer being sued for wearing 6 hats – being paid on one file as lawyer, director, consultant, finder, shareholder, and as advisor. In addition to receiving 95% of all the RSU meant for employees of the issuer. He drafted all of the documents to give himself compensation, and as a director, never recused himself from a consent resolution of filed a notice of conflict form with the resolution.

It is possible, but doubtful, that the rules changed allowing lawyers to act as a director of an issuer for compensation, as well as to accept shares and options for free from the issuer, and then to put on a third hat and act as legal counsel for compensation. How such a lawyer attends an AGM, or writes the Information Circular in respect thereof for that matter, keeping those three different hats on his head is a kind of a neat hat trick.

Back to the issuer; several more natural persons then joined the issuer, including a Polish national named Kazimierz Malik. Around the same time, a Vancouver person named Marc Crimeni, appeared in a Sedar filing of the issuer as a material shareholder and director.

Crimeni was banned from being a director of an issuer in British Columbia for a short period of time over a failure to disclose that he was facing a criminal charge over improperly storing a gun.

Later, the issuer announced that Crimeni was its “founder” and that he relocated to the EU.

Wait – its founder?

Not according to the securities law disclosure record. According to that, the founders were the promoter Haslinger, Ron Miles, Paul Fong, Alex Kim and David Franklin, and copies of their share subscriptions for founder shares are filed on Sedar.

So what was Cremeni’s role and how long he was with the issuer is unknown.

The issuer then changed its name once more to Sativa Wellness Group Inc. and then Covid hit the world, and then a lawsuit hit the issuer.

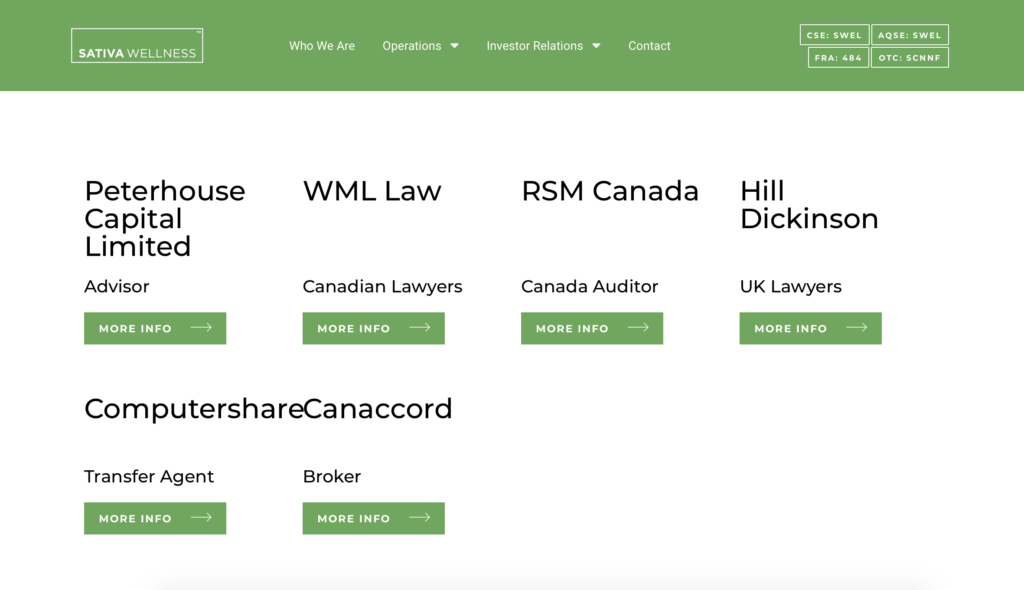

Update: The issuer changed its name once more and is now Goodbody Health, and on its website, its Canadian address is the address of microcap lawyer William Macdonald.