The Securities and Exchange Commission (“SEC“) today filed a complaint in the Southern District of New York, charging eight defendants, half of whom are from Vancouver, with alleged securities fraud that allegedly generated US$145 million in proceeds of crime.

In a parallel criminal proceeding over the same alleged scheme, the US government filed three indictments against ten defendants, four of which are the defendants in the SEC action and one of whom is a full-patch member of the Hells Angels in British Columbia.

The SEC Case

In the SEC case, the defendants are David Sidoo, Ronald Bauer, Craig Auringer, Adam Kambeitz, Alon Friedlander, Massimiliano Pozzoni, Daniel Mark Ferris and Petar Dmitrov Mihaylov. Mihaylov’s nick name is “Petar the Bulgarian”.

Among the public companies they are alleged to have used for securities fraud, is a British Columbia microcap public company named American Helium Inc.

Bauer runs a VC firm and is alleged by the SEC to be the ring leader of the stock scheme.

Sidoo lives in Vancouver and used to be a stockbroker. He was convicted in the US of participating in the College Admissions Scandal. He paid $200,000 for someone else to ghost-write the SAT exams for his two children so that they could get into elite US universities.

The indictment against Sidoo in the College Admissions Scandal case alleged that he planned to pay again for a ghost exam writer to take the LSAT for his son in Vancouver to get into law school but the plan wasn’t put into place when a fake ID ordered from China was of low quality.

Sidoo entered into a deal to plead guilty to lesser charges and serve three months in jail in connection with the US charges and was released in December 2020. He was in the news afterwards in connection with a Covid-19 party at his $35 million Vancouver mansion, where some attendees overdosed on illegal drugs (they were attended to by BC emergency personnel).

At sentencing for the College Admissions Scandal case, Sidoo said he hoped people would not judge him. His lawyer told the judge at sentencing that Sidoo made one mistake which was, he represented to the court, inconsistent with “his entire personal life story.” In an interview here after his release from jail, Sidoo stated that everyone makes mistakes but “you move on from it.”

According to a plain reading of the SEC complaint, and assuming the allegations are true, he did not move on from it, and the fraud committed under the College Admissions Scandal clearly was not inconsistent with his entire personal life story.

The SEC says that, with the other defendants, Sidoo participated in an illegal pump and dump scheme that started in 2006 that involved, for the group, at least 17 public companies. The SEC alleges the defendants controlled stock which was not disclosed, paid for misleading promotions of the stock of several public companies to lure innocent investors to invest and then sold their inflated stock and funneled the proceeds to themselves through offshore entities to obfuscate the transactions. Innocent investors were left holding the bag of much depreciated stocks.

The defendant Craig Auringer is a Vancouver native, whom the SEC says, ran the promotions for the alleged pump and dump schemes. He used to hang out in the Vancouver Yaletown club scene, and dated one of the women from the TV show “Real Housewives of Vancouver.”

Two of the defendants are recidivists – Bauer (see here) and Mihaylov, thus it seems likely that to denunciate and deter, they and Sidoo will face maximum penalties if convicted.

For over two years, we’ve been tracking and data-basing certain stock promoters, lawyers, auditors, finders fee recipients, and hidden control persons operating in British Columbia’s capital markets – we know from network analysis of our database that some of the persons and entities connected to this SEC complaint were in the Vancouver Blockchain, then ICO space, with two microcap public companies that went bust after raising tens of millions of dollars, and the exact same people are presently raising money from investors in the NFT space.

Not surprisingly, this is another hidden control person case. For decades, Vancouver capital markets players have ignored the rules against secret control persons hidden behind microcap public companies, regardless of how often the SEC or US government takes enforcement or criminal action against the Vancouver capital markets ecosystem. In a 34-year-old case that we dug up (here), Vancouver’s Madam Justice Southin, who was an iconic judge, warned Vancouver capital markets players against using whom she called “monkeys” (facilitators) to commit securities fraud by not disclosing control persons to investors.

Criminal Indictments and Hells Angels

At the same time, the US Attorney for the Southern District of New York, and Michael Driscoll, the Assistant Director-in-Charge of the New York Office of the FBI, announced parallel criminal proceedings in connection with an alleged US$100 million securities fraud scheme involving similar conduct described in the SEC complaint but against ten defendants, including Bauer, Auringer, Ferris and Mihaylov (but not the other four).

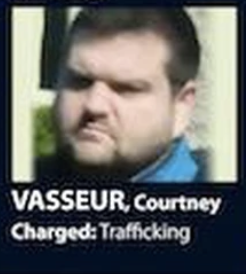

The other defendants in the criminal actions are Chris Lehner, a/k/a “Santa”, a Canadian, Julius Csurgo, a/k/a Gyula Karoly Csurgo, a Hungarian national, Anthony Korculanic, a Croatian national, Dominic Calabrigo, a Canadian, Hasan Sario, a Turkish national, and Courtney Vasseur, a Canadian who goes by the name “Arctic Shark”. The US government says that they sought the assistance of Guernsey and Crypus, among others, for intel and evidence – those two jurisdictions are interesting because they are the preferred jurisdictions of Russian, Ukrainian and other Eastern European members of organized crime for corporate entities. They are favored because like British Columbia, their incorporation structures are designed to be impenetrable to law enforcement, preventing the ascertainment of the identity of legal shareholders of companies.

According to the Combined Forces Special Enforcement Unit in British Columbia (see here), “Arctic Shark” is a full-patch Hells Angels, who belongs to the Nomads chapter, with previous charges for drug trafficking.

Bauer, Lehner, Vasseur, Csurgo, Korculanic, Mihaylov and Calabrigo were arrested in different countries, which is quite a coordination achievement by law enforcement agencies who have to move at the exact same time to arrest alleged securities fraudsters so that no one target makes a phone call to inform the others. Three others remain at large.

The indictments for the criminal charges include money laundering and are somewhat vague as to all the companies involved and other participants, which usually means that information is being withheld because it ties into ongoing investigations. The indictment for “Arctic Shark” is here.

How a known member of a translational criminal organization (the Hells Angels) was able to infiltrate the capital markets in British Columbia, instruct local solicitors, participate in the creation of disclosure material with solicitors, and have bank accounts to receive proceeds of the alleged securities fraud is something no doubt all of Vancouver is waiting to learn from the US Department of Justice once Vasseur is extradited.

Some of the information that is disclosed in the criminal indictments, especially the alleged use of Swiss platforms, as well as the alleged Hells Angels connection, seems to suggest that it ties into the global Frederick Sharp, Avtar Dhillon et. al. prong of cases (our slow burn summary of those allegations here). Not just that, we believe that Csurgo was a client of the Frederick Sharp group, which is another tie to that case.

The Frederick Sharp, Avtar Dhillon et. al. prong of cases include a US$1 billion set of allegations by the SEC that Vancouver capital markets players set up what can be described as a factory of fraud in downtown Vancouver which offered specialized services – those specialized services were allegedly securities fraud services involving a circle of gate-keepers and facilitators who allegedly, among other things: helped harvest and acquire shell and shelf companies; helped secret control persons hide their control of the stock of microcap public companies; helped complete RTOs; helped advise on, write and disseminate press releases and other disclosure material containing false information about microcap public companies to cause the stock price to jack up; helped create false central securities registers that falsely reflected the names of shareholders; created false legal opinions so that securities could be free-trading and which contained false information about control persons; promoted the stock to innocent investors; sold the stock at artificially high prices to enrich members of the alleged organized fraud scheme; used offshore brokerage and bank accounts to hide the movement of the proceeds of securities fraud; and then layered, and integrated all the proceeds – US$1 billion of it – right back into Vancouver through the gate-keepers and facilitators.

Where did the proceeds end up? Chances are high, if the allegations are true, that it was integrated into the financial system for the purchase of mansions, luxury cars, private schools, fancy watches, fast boats and trips on private jets because, after all, it’s Vancouver.