Canada still on the Majors List

Canada made it on the “Majors List” in the annual US State Department’s International Narcotics Control Strategy Report (“INCSR“) again this year.

The Majors List is three lists and it designates countries that are (1) “Major Illicit Drug Producing and Drug Transit Countries”; (2) “Major Precursor Chemical Source Countries”; or (3) “Major Money Laundering Countries”. In 2020, Canada is on two of the three Majors List as both a “Major Money Laundering Country” and a “Major Precursor Chemical Source Country”.

Canada a “Major Money Laundering Country”

The 2020 INCSR, published last week by the US Department of State, identifies Canada as a “Major Money Laundering Country†along with several others including some well-known money laundering countries such as St. Kitts and Nevis, Dominican Republic, Mexico, Argentina, Venezuela, Vietnam, Belize, Curacao, Brazil, BVI, Cayman Islands, Colombia and Iran.

A “Major Money Laundering Country†is defined under US law as one whose financial institutions process financial transactions involving “significant amounts of proceeds of crime from international narcotics (“narco“) trafficking. Based on changes to money laundering typologies, that definition was expanded to include professions (e.g., tax advisors, accountants, company incorporators, lawyers), non-financial businesses (“NFB“) (e.g., casinos) and alternative value transfers (e.g., digital currencies) to recognize countries whose banks, NFBs, professions and other value transfer systems process transactions involving significant amounts of not just drug trafficking but also proceeds of crime from serious crimes.

Canadian banks and professions are dealing with “significant” proceeds of crime from narco trafficking and serious crimes

As a result of being on the Majors List, the 2020 INCSR found that Canada’s banks, NFBs (such as casinos), professions (such as accountants, tax advisors, lawyers), and alternative value transfer systems (such as Bitcoin and Bitcoin exchanges), deal with and process significant amounts of proceeds of crime from narco trafficking and from serious crimes.

The 2020 INCSR also identified Canada as a “Major Precursor Chemical Source Country†along with several other intense drug producing countries such as Argentina, Afghanistan, Chile, Colombia, Dominican Republic, Ecuador, El Salvador, Mexico and Russia.

This year’s report is different however, with many new areas of concern for money laundering in Canada identified and several others that were identified in the past that are now gone, which may mean that Canada has made a dent in financial crime mitigation or that high risk areas have shifted (to the darknet and Bitcoin), or perhaps both.

10 areas of money laundering concern for Canada in the 2020 INCSR

There are 10 points of concern in the 2020 INCSR in respect of Canada as follows:

One – Digital currencies and real estate used for criminal activities

According to the 2020 INCSR, there is room for improved collaboration with Canada in three areas namely, digital currencies (like Bitcoin); the darknet (which by definition mean Bitcoin and so-called dark coins); and real estate transactions.

The 2020 INCSR specifically says that the US would welcome further collaboration with Canada on strengthening coordination on real estate and digital currencies used for criminal activities and investigations involving the darknet.

Two – Canada is shipping containers of cannabis to the UK

The 2020 INCSR reports that the UK has reported the illegal importation of large shipments of containers of cannabis from Canada.

Three – Violent Nigerian narco trafficking a problem in Canada

Nigerian based narco trafficking networks are popping up in Canada, following a path of similar pop-ups in France, and they are engaging in violent turf wars. The threat has grown in Canada to such an extent that the RCMP is planning to open an office in Nigeria in 2020 to address the growing threat to Canada of narco trafficking of Nigerians. The INCSR notes that illicit drugs often transit through Mozambique after Nigeria before arriving in Canada.

Four – Cocaine from Colombia coming to Canada from Guyana

Colombian cocaine trafficked to Canada is being transited from Guyana, after first being smuggled from Colombia to Venezuela. The cocaine is hidden in commodities to make it past borders. Canada is now the largest importer of goods from Guyana. TCOs use trade partners, and in fact often create them, to narco traffic. The commodities used to smuggle cocaine from Guyana to Canada would likely include shipments of sugar, rice and vehicles.

Five – Shelf companies used by criminals, narco traffickers and money launderers

Perhaps one of the most important parts in the 2020 INCSR is the concern expressed over the use of shell companies used by narco traffickers, criminal organizations, PEPs and regimes to evade sanctions and launder money, and of shelf companies to hide the true identity of shareholders of private companies for money laundering. Canada, and Vancouver in particular, has a pervasive use of shell and shelf companies, both of which are typically created and sold by larger law firms. In this post from 2016, we explain the difference between shelf companies, shell companies, numbered companies and beneficial ownership. As noted in the 2020 INCSR, the opacity of corporate structures through shell and shelf companies is of serious concern in the anti-money laundering law community.

Six – Canada requires a visa for St. Kitts and Nevis passport holders

Probably as a result of the program of St. Kitts and Nevis where anyone from anywhere can buy a passport from St. Kitts and Nevis provided they paid hefty fees and invest in a hotel-chain condo unit or a “sugar fund”, the 2020 INCSR mentions that Canada now requires that people who hold a passport from St. Kitts and Nevis must apply for a visa before entering Canada because they are high risk. For example, the Iranian foreign national, Ali Sadr Hashemi Nejad, who is on trial in the SDNY for money laundering and sanctions avoidance, was able to buy a St. Kitts and Nevis passport right after the US stripped him of a previously approved asylum claim and he was forced to leave the US.

Seven – Canadian marijuana producers are shipping product to the Caribbean

Eastern Caribbean countries such as Barbados and Antigua report an increase of marijuana being illegally imported that is from Canada, of a high grade, meaning it’s originating from British Columbia, a sign that Canadians are expanding their own narco trafficking activities.

Eight – Transnational criminal organizations in Canada are still narco trafficking cannabis to the US

Several transnational criminal organization in Canada are still exporting cannabis products into the US illegally.

Nine – Proceeds of crime from other countries is laundered in Canada

According to the 2020 INCSR, proceeds of crime that are foreign generated are parked in Canada and laundered and that laundering process involves professional money launderers, constituting a key threat.

Ten – Canada has a proliferation of professional money launderers

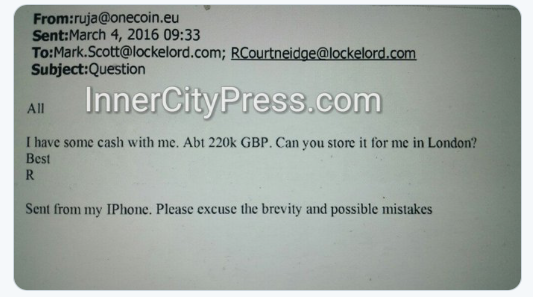

The 2020 INCSR identifies that Canada has professional money launderers used by transnational organized crime groups and narco traffickers and moreover that the access of transnational criminal organization to professional money launderers represents the most threatening and sophisticated actions in Canada.

Why is there an annual INCSR produced by the US State Department?

Pursuant to US law for foreign assistance, the US government makes an assessment in connection with providing foreign aid to countries (whether financial, technical, intelligence or other aid and assistance) of the extent to which countries comply with international treaties they signed in respect of financial crime. For example, Canada signed the United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances which requires taking effective action against money laundering. Under US law, financial aid and assistance can be withheld for countries on the Majors List when they fail to meet international treaty obligations in respect of money laundering, narco trafficking and illegal drug production. And thus the annual report is to evaluate compliance by countries with narcotics and money laundering treaties for financial assistance.